Swatch Group has released its half-year financial results for 2024, revealing significant declines in sales, operating profit, and net income, largely due to a steep drop in demand for luxury goods in China. Despite the downturn, the iconic Swatch brand managed to defy trends, posting a 10% sales increase in China.

Financial Highlights

- Net Sales: CHF 3,445 million, down 14.3% from the previous year at current exchange rates (-10.7% at constant rates). The company faced a negative currency impact of CHF 145 million.

- Operating Profit: Dropped to CHF 204 million from CHF 686 million last year, with the operating margin narrowing to 5.9% from 17.1%.

- Net Income: Decreased to CHF 147 million from CHF 498 million, resulting in a net margin of 4.3%, down from 12.4%.

- Net Liquidity: CHF 1,434 million, a decrease from CHF 1,988 million at the end of December 2023.

- Equity: Slightly decreased to CHF 12.2 billion from CHF 12.3 billion, maintaining a high equity ratio of 85.8%.

Market and Segment Performance

The decline in sales was predominantly driven by reduced demand for luxury goods in China, including Hong Kong and Macau. The Watches & Jewelry segment, excluding Production, experienced an operating margin decrease to 11.0%, compared to 19.0% the previous year. This segment’s performance was negatively affected by sustained marketing investments and the overall market environment.

Conversely, sales outside China remained robust, reaching levels comparable to the record year of 2023. Total sales outside China were 5.6% higher than the first half of 2022 at constant exchange rates.

Production and Retail Highlights

The Production segment faced significant challenges, with sharply reduced orders leading to negative operating results. Swatch Group chose to maintain all production capacities and avoided layoffs, a strategy aimed at quicker recovery during future upswings.

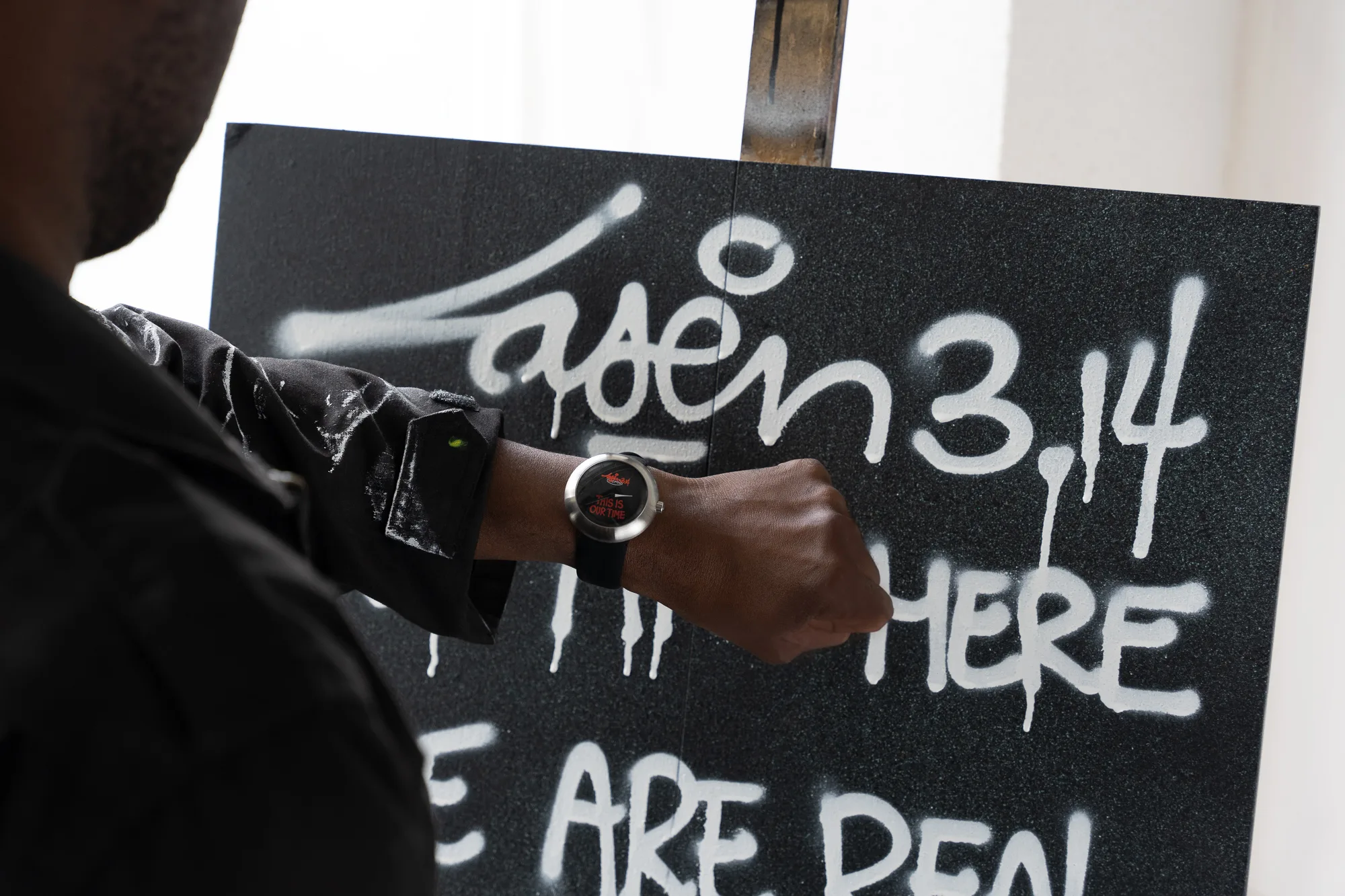

Retail activities of the group hit a milestone, surpassing 45% of total sales in the Watches & Jewelry segment. The Swatch brand performed exceptionally well in China, contrasting with the broader market trends.

Regional Insights

- Europe: Stable sales in the company’s retail business, though geopolitical tensions led to a cautious approach among European retailers, reducing wholesale sales by over 10%.

- USA and Japan: Both markets reported strong performances. The USA maintained last year’s record sales, while Japan saw over 30% growth.

- Other Markets: Countries like South Korea, India, and the UAE showed significant improvements over the previous year.

Outlook for the Second Half of 2024

Swatch Group anticipates continued challenges in the Chinese market for the luxury goods sector but remains optimistic about opportunities for growth in lower-priced segments. Strong growth is expected in Japan and the USA, driven by investments in the retail network and global media exposure from events like the Olympic Games in Paris, where Omega serves as the official timekeeper.

The cost-cutting measures introduced earlier in the year are expected to show more pronounced results in the second half, particularly in the Production segment. The company forecasts a significant improvement in performance for the latter half of 2024.

Conclusion

Swatch Group’s first-half results reflect the volatile global market conditions, with notable impacts from the Chinese market. However, strategic decisions and resilient performance in certain regions provide a positive outlook for the remainder of the year.

For more information, please visit SwatchGroup.com.

Note: The above article is a summary of Swatch Group’s financial results for the first half of 2024, based on unaudited figures.