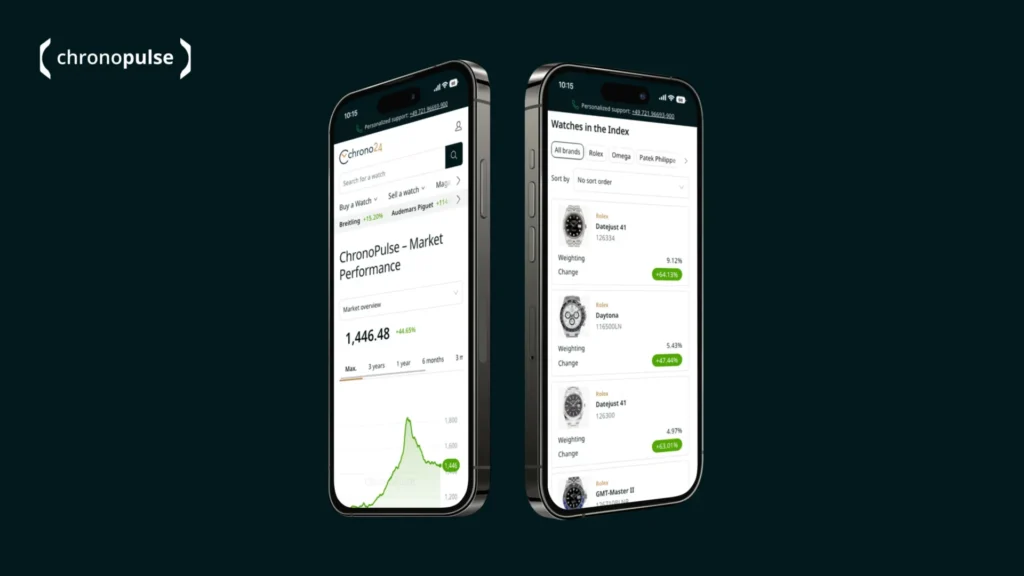

ChronoPulse Watch Index: Secondary Market for Luxury Watches Declined Slightly in the Second Quarter of 2024

The secondary market for luxury watches experienced a slight downturn in the second quarter of 2024, as reported by Chrono24, the world’s leading online marketplace for luxury watches. According to the latest analysis using the ChronoPulse Watch Index, the market saw an average value decline of 0.99%. This follows a similar trend from the same quarter last year, which saw a decrease of 0.81%.

Brand Performance Fluctuations

The ChronoPulse Watch Index, which evaluates real sales data, highlighted varying performance among luxury watch brands. Only Cartier and Breitling recorded an increase in value, with rises of 6.14% and 1.71%, respectively. Conversely, Vacheron Constantin, Panerai, and Hublot suffered the most significant losses, with values dropping by 6.31%, 6.04%, and 3.51%, respectively. Other notable declines included IWC (-2.94%), Jaeger-LeCoultre (-2.71%), and Rolex (-1.74%).

Market Dynamics and Expert Insights

Balazs Ferenczi, Head of Brand Engagement at Chrono24, provided insights into the market’s dynamics. “Since prices within the secondary market for luxury watches have fallen continuously since March 2022 due to the changed interest rate environment and the economic uncertainties caused by the war in Ukraine, there were initial signs in the first quarter of 2024 that a bottom had been reached. While the European Central Bank recently lowered the key interest rate for the first time, this step has not yet been taken on the US market, which is extremely important for the secondary market for luxury watches. If this happens in the second half of the year, this decision should also have a positive effect on the luxury watch secondary market.”

Ferenczi also noted the shifting market demographic. “In the hype phase between 2020 and 2022, the watch market was driven by opportunists who sensed a good business in buying and selling luxury watches. Passionate collectors and watch enthusiasts are now once again the core of the market. This means that at Chrono24, despite the price drop on the secondary market for luxury watches, we have not seen a decline in the transaction volume on our platform. Quite the opposite: passionate watch lovers are happy to be able to buy their favorite watches at cheaper prices and may even expect value gains in the long term. After all, the entire secondary market for luxury watches is still up more than 30% over a five-year period and is therefore performing just as well as well-known stock ETFs in the long term.”

Conclusion

The second quarter of 2024 saw a minor decline in the luxury watch secondary market, reflecting broader economic uncertainties and interest rate fluctuations. However, the resilience of passionate collectors and enthusiasts suggests a stable transaction volume and a potential for long-term value gains. The ChronoPulse Watch Index remains a critical tool for tracking these market movements, providing precise insights based on real transaction data. As the market adjusts, the future may hold positive developments, particularly if economic conditions improve.

For more detailed insights, visit the ChronoPulse Watch Index at Chrono24 ChronoPulse.

Visit Chrono24 for more information.