Swatch Group Reports Strong Financial Performance Amid Global Economic Challenges

In an ad hoc announcement pursuant to Article 53 of the Listing Rules, the Swatch Group revealed impressive financial results for the fiscal year, showcasing resilience in the face of global economic uncertainties.

Key Financial Highlights:

- Net Sales Growth: The Swatch Group reported a substantial net sales increase of 12.6% at constant exchange rates, reaching CHF 7,888 million. Despite challenging market conditions, the company achieved a 5.2% growth at current rates.

- Segment Performance: The Watches & Jewelry segment, including Production, maintained a robust operating margin of 17.2%, showcasing the company’s ability to navigate significant exchange rate impacts.

- Operating Profit: Operating profit saw a notable increase, reaching CHF 1,191 million compared to the previous year’s CHF 1,158 million. However, the operating margin slightly dipped from 15.4% to 15.1%.

- Net Income: Net income exhibited strong growth, rising by 8.1% to CHF 890 million, with a net margin of 11.3%, up from 11.0% in the previous year.

- Investments: The Swatch Group doubled its investments to CHF 803 million, allocating over CHF 300 million to production equipment and CHF 220 million to retail properties in prime locations.

- Cash Flow and Liquidity: Operating cash flow amounted to CHF 615 million, while net liquidity reached CHF 1,988 million. The company remains financially robust despite challenges.

- Job Creation: The Swatch Group created 1,541 additional jobs, with 802 positions based in Switzerland, emphasizing its commitment to workforce development.

- Dividend Proposal: The Board of Directors proposed an 8.3% higher dividend of CHF 1.30 per registered share and CHF 6.50 per bearer share at the Annual General Meeting on May 8, 2024.

Outlook and Growth Prospects:

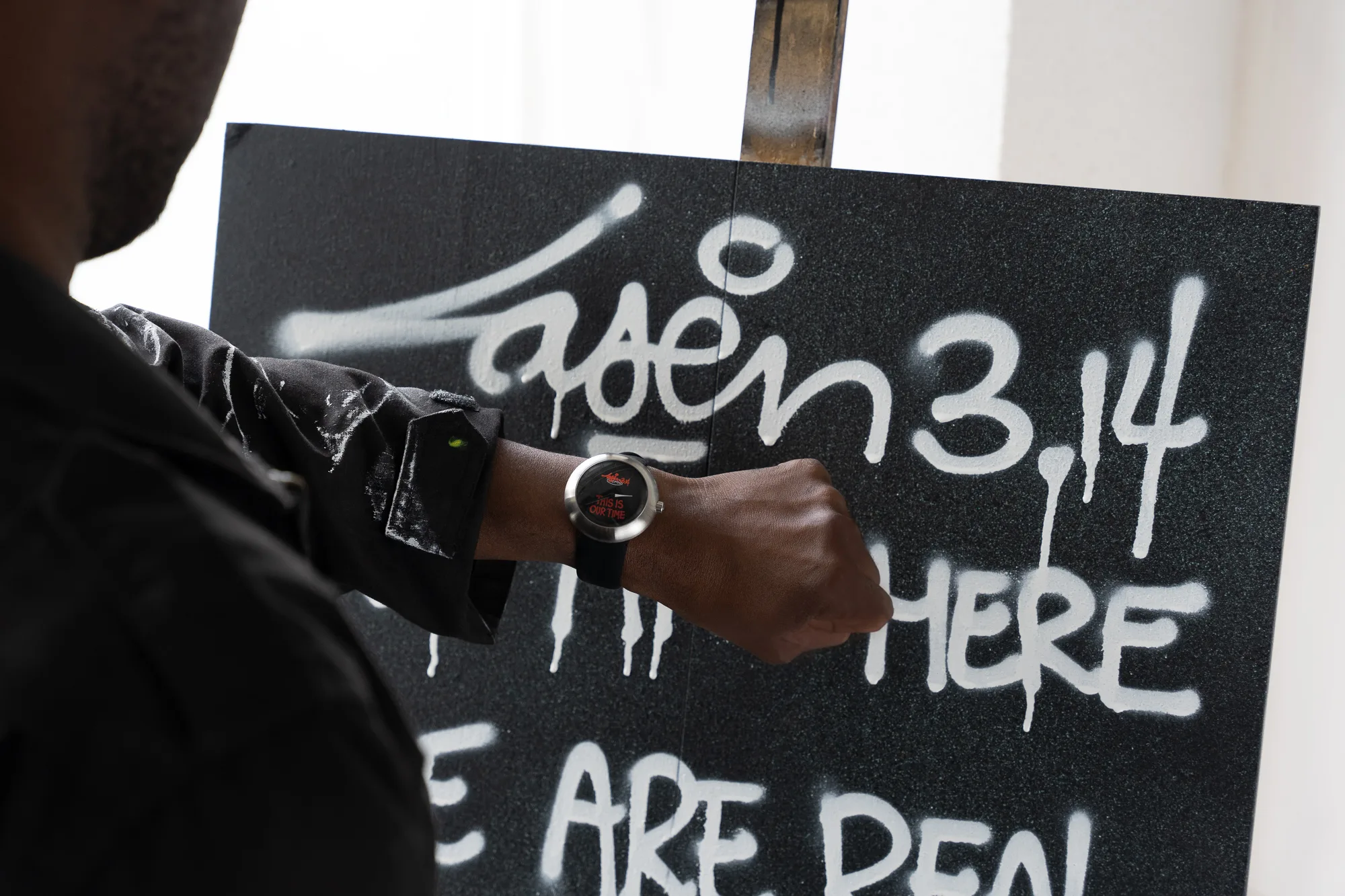

Looking ahead to 2024, the Swatch Group anticipates excellent growth prospects, especially in the lower and medium price segments. Despite the strength of the Swiss franc, the company’s iconic brand Swatch marked a strong start to the year with the global launch of the Scuba Fifty Fathoms “Ocean of Storms” on January 11, 2024.

The Group foresees promising opportunities for further growth in local currencies in 2024. Notable projections include Harry Winston surpassing one billion in turnover, and brands like Swatch, Tissot, and Longines continuing to thrive in the lower and medium price segments. Omega is expected to benefit from global media exposure as the official timekeeper of the Olympic Games in Paris.

While the Swatch Group acknowledges potential challenges due to exchange rate movements, its strong industrial base in Switzerland positions it for continued success in the global market.

These financial results underscore the Swatch Group’s resilience and strategic positioning amid a dynamic economic landscape. Investors and industry observers are closely watching as the company navigates the complexities of the global market in the coming year.

For more information, please visit SwatchGroup.com.